Financial literacy campaigns trends you can’t ignore

Financial literacy campaigns are essential initiatives that educate individuals on managing finances effectively through personalized learning experiences, digital engagement, and community involvement, ultimately enhancing financial knowledge and decision-making.

Financial literacy campaigns trends are evolving and play a crucial role in shaping our understanding of money management. Have you noticed how these initiatives are becoming more visible in communities? Let’s dive into what’s changing and why it matters.

Emerging strategies in financial literacy campaigns

Financial literacy requires innovative approaches to engage different audiences. Emerging strategies in financial literacy campaigns focus on personalization and technology. These methods help individuals understand and manage their finances better.

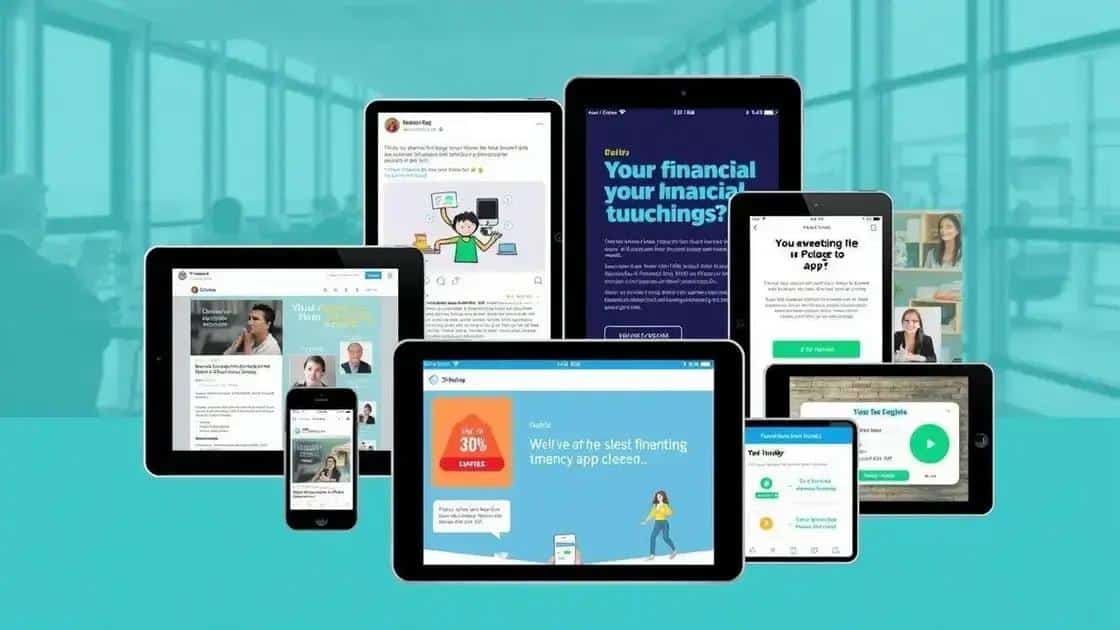

Use of Digital Platforms

Digital media plays a significant role in spreading financial knowledge. Social media campaigns target younger populations effectively, allowing quick sharing of important information. Additionally, apps designed for budgeting and finance education make learning accessible and engaging.

Community Engagement

Building connections at the community level yields better results. Collaborating with schools and local organizations helps adapt messages to specific needs, making financial literacy more relatable and impactful.

- Workshops and seminars that address local financial challenges.

- Peer-to-peer mentorship programs promoting shared learning.

- Incentives for participation to encourage involvement.

Moreover, combining in-person and online resources enhances campaign reach. Platforms that offer both video tutorials and face-to-face sessions cater to diverse learning preferences. This flexibility can lead to a more motivated audience eager to learn.

Data shows that visual aids significantly enhance understanding. Incorporating infographics in these campaigns captures attention and reinforces educational material. Such strategies can transform complex topics into easily digestible content.

The collaboration with influencers also boosts outreach. Influencers can effectively champion financial literacy campaigns, making it hip to be financially savvy.

Impact of digital media on financial education

Digital media has changed the way we approach financial education. It allows quick access to information and a variety of resources. With just a few clicks, anyone can find helpful tips and tools for managing money.

Engagement through Social Media

Social media platforms have become vital for learning about finances. These platforms offer engaging content, such as videos, infographics, and podcasts. They not only provide information but also create communities where people can share experiences and learn from each other.

Interactive Learning Tools

Online tools and apps make financial education fun and interactive. Users can access quizzes, budgeting tools, and simulators that mimic real financial scenarios. Gamifying lessons helps maintain interest and enhance understanding.

- Budget calculators that provide instant feedback on spending habits.

- Online workshops that allow participation from anywhere.

- Video tutorials that break down complex concepts into simple, digestible parts.

Moreover, digital platforms provide personalized learning experiences. Users can choose topics that interest them and learn at their own pace. This flexibility is particularly useful for those with busy schedules or different learning styles.

Webinars and live discussions further expand avenues for interactive education. These formats allow for real-time questions and answers, enhancing comprehension and retention of information. People feel more empowered when they can engage directly with experts.

Case studies of successful literacy initiatives

Exploring case studies of successful literacy initiatives reveals effective strategies that can be replicated. These examples showcase how targeted approaches lead to significant improvements in financial knowledge.

Project O.N.E.: A Community-Based Approach

Project O.N.E. demonstrates how community involvement can elevate financial literacy. This initiative partnered with local businesses and schools to create workshops focused on budgeting, saving, and investing. Participants reported higher confidence in managing their finances after completing the program.

Digital Literacy Program: Using Technology

Another notable case is the Digital Literacy Program, which utilizes online resources to teach financial skills. By providing interactive tools and videos, learners could absorb information at their own pace. This flexibility made it easier for participants to engage with the material and apply it in real-world situations.

- Increased engagement through gamified learning elements.

- Personalized feedback based on user performance.

- Accessibility for various age groups and backgrounds.

The success of these initiatives often stems from innovative methods that cater to different learning styles. Some communities have embraced peer-led sessions, where individuals share their experiences, creating a supportive environment. This sense of community can motivate participants to remain committed to improving their financial skills.

Moreover, ongoing support after completing courses is vital. Many successful programs offer follow-up sessions, helping individuals apply what they’ve learned. These extensions can include mentorship opportunities or additional resources to reinforce knowledge.

Future directions for financial literacy campaigns

Looking ahead, future directions for financial literacy campaigns are promising and varied. Embracing new technology and innovative strategies will be critical in reaching broader audiences.

Personalized Learning Experiences

One key trend is the move towards personalized learning experiences. Tailoring content to meet individual needs can greatly enhance engagement. For instance, apps that adapt to user input will allow people to learn at their own pace, making financial education more relevant and accessible.

Collaboration with Technology Companies

Another direction involves collaboration with tech firms to create user-friendly platforms. By leveraging the latest technology, campaigns can deliver engaging interactive content. These partnerships can also help develop new tools that make financial management more straightforward.

- Smart budgeting tools to track expenses automatically.

- Chatbots that provide quick responses to financial questions.

- Virtual reality experiences simulating real-life financial scenarios.

In addition, social media will continue to play a crucial role. As more people turn to online platforms for information, engaging social media campaigns can drive awareness and participation. Creating shareable content that educates while entertaining can expand the reach of these initiatives.

Moreover, it’s essential to address evolving financial challenges. As the economy changes, campaigns must adapt to teach relevant topics. This could include lessons on cryptocurrency, digital banking, or changes in consumer protections. Keeping content timely ensures it meets the audience’s needs.

FAQ – Frequently Asked Questions about Financial Literacy Campaigns

What are financial literacy campaigns?

Financial literacy campaigns are initiatives aimed at educating people about managing money, budgeting, investing, and understanding financial products.

How do digital media impact financial education?

Digital media makes financial education more accessible through interactive tools, social media engagement, and online resources that cater to various learning styles.

Why are personalized learning experiences important?

Personalized learning helps individuals grasp financial concepts better by addressing their specific needs and preferences, making education more effective.

What role does community engagement play in these campaigns?

Community engagement fosters trust and relevance, ensuring that financial education meets local needs and encourages participation through relatable programs.